Traffic accident insurance is a very important system that covers the payment of damages.

There are several types of insurance available for traffic accidents, but if you don’t know the type and content correctly, you may not receive the insurance you should receive.

So, this time, I’ll explain the type and content of insurance that can be used in traffic accidents.

The type and content of insurance that can be used for traffic accidents

Car insurance

Car insurance is a typical example of traffic accident insurance.

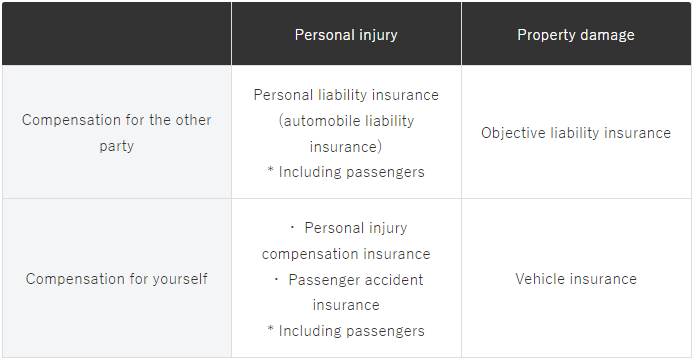

The contents of car insurance can be roughly separated into the following two.

Compensation to the other party

Your own compensation

In addition, the two types of insurance can be divided into injury insurance (personal injury) and automobile/property (property loss).

From now on, the interpretation of the insurance frequently shows the name of the insured person.

An insured person means a person who plays a central role in compensation.

Only the insured person is the person who can register the coverage of the insured as standard.

The insured person who is registered is the person listed on the insurance policy.

Coverage specifies the insured people around this group.

For example, if insurance is declared to apply to a spouse, child, or parent, the insurance applies to the insured spouse, child, or parent.

Registered policyholders are the main drivers of the main vehicles.

The insured person does not necessarily have to be a registered insured person.

Contents and relationship between liability insurance and liability insurance

The insurance that covers damages to the other party is California Civil Liability Insurance and Personal Liability Insurance.

Car liability insurance is insurance under the jurisdiction of the government and is mandatory insurance that must be covered to drive a car.

If you do not subscribe, fines and payment limits are legal.

Personal liability insurance is one of the auto insurance products of voluntary insurance companies.

Due to the options, the subscription itself is optional and policyholders can set insurance payment limits.

Personal liability insurance is related to additional liability insurance.

If you are injured in an accident, insurance will provide you with California insurance first.

If the amount of damages, such as medical expenses and alimony, exceeds the limit for payment of mandatory car liability insurance, voluntary insurance liability insurance will assume the cost oversteer.

Personal Injury Compensation Insurance

Personal injury compensation insurance is the insurance that insurance companies take out insurance.

This insurance has nothing to do with the negligence of the insured.

Therefore, regardless of the insured person’s negligence rate, insurance claims can be received according to the amount of loss.

In addition, both the victim and the aggressor take out this insurance, and the insurance alone does not lower the insurance note.

It is paid at the actual rate, as is the case with the passenger accident insurance described against you.

Passenger accident insurance

There is also passenger accident insurance as insurance to cover injuries for you and your passengers.

Such passenger accident insurance, commonly called sympathy money, is paid separately from personal injury compensation insurance.

Depending on non-life insurance companies, one-time payments are available, allowing you to decide how many hospitalizations per day or how many are hospitalized per day.

Different from personal injury compensation insurance, coverage is a fixed amount.

For each individual in the contracted vehicle, the amount paid will vary depending on the symptoms and parts.

Target liability insurance

Target liability insurance covers damage to the other party’s property and car.

It should be noted here that compensation for the loss of ownership of the other party is beyond the scope of liability insurance.

Therefore, if the other party is only car liability insurance, car repair and alternative vehicle fares are not covered by insurance and must be charged directly to the other party.

In addition, as with personal liability insurance, policyholders can set a limit on the amount they pay for insurance.

Vehicle insurance

Vehicle insurance is insurance that covers damage to your car.

You will receive compensation, including the negligence of the insured, unless you intentionally collide with the car.

Product names vary from insurer to insurer, but there are common types that address all risks and economic rates that limit the damage that is applied.

In economic type, it is not an accident between car accidents and collisions are not compensation targets.

The special contract for driving other vehicles

Other special car driving contracts are special contracts that allow you to use your own car insurance to obtain compensation, even if there is an accident while driving the car (for example, when you rent a friend’s car or rent a car).

When using insurance, premiums will increase in principle and will fall from next year.

The owner did not cause the accident himself, but using the owner’s insurance could cause the loaner to step on or kick.

Therefore, other special car driving contracts are paid for repairs with the actual driver’s insurance.

In addition, to use this insurance, you need to apply for vehicle insurance.

If you purchase economy vehicle insurance, or if economy (car damage accident, crash, etc.) is not eligible, you are not eligible for this special contract.

This special contract covers only accidents while driving.

Accidents do not apply when the vehicle is parked or parked.

cheapest buy enclomiphene purchase in canada

enclomiphene order overnight shipping

kamagra médecins en ligne

achetez kamagra en ligne avec livraison le lendemain

discount androxal no prescription needed

buy cheap androxal no prescription online

how to buy flexeril cyclobenzaprine cost on prescription

how to buy flexeril cyclobenzaprine generic when will be available

how to order dutasteride buy in the uk

buying dutasteride australia purchase

online order gabapentin price in us

how to buy gabapentin cost australia

cheapest buy fildena uk order

purchase fildena australia discount

itraconazole online canada

how to buy itraconazole united kingdom

staxyn and overnight

order staxyn for sale usa

purchase avodart no prescription online

get avodart generic best price

xifaxan overnight without prescription

how to buy xifaxan medication interactions

buy cheap rifaximin canada fast shipping

online rifaximin canada

koupit kamagra online předpis

kamagra s lékařem konzultovat